Expanding into North America represents a major growth opportunity for ambitious brands that have already found success in their home markets. The region offers strong consumer spending, mature digital infrastructure, and access to global business networks. At the same time, it is highly competitive, culturally nuanced, and unforgiving to companies that underestimate the complexity of entry.

Many international brands assume that a strong product alone is enough to win market share. In reality, success depends on preparation, positioning, and a clear understanding of how buyers in the United States and Canada evaluate new brands. This blueprint outlines the strategic considerations that matter most when entering this market and how companies can reduce risk while accelerating traction.

Understanding the North American Business Landscape

North America is not a single market. It is a collection of regions, industries, and consumer expectations shaped by decades of competition and innovation. Buying behavior varies widely by geography, income level, and cultural norms. What works in one state or province may fall flat in another.

Customers are accustomed to choice and transparency. They research heavily, compare options, and expect clear value propositions. Trust plays a critical role, especially when dealing with a brand they have never encountered before. This means that credibility must be built quickly and reinforced consistently.

Regulatory environments also differ. Compliance requirements, data privacy rules, and industry standards must be addressed early to avoid costly delays or reputational damage.

Defining Your Market Entry Strategy

A successful market entry begins with focus. Trying to appeal to everyone at once usually results in diluted messaging and wasted resources. Instead, brands should identify a clear initial segment.

This may be a specific industry, customer profile, or geographic area. Narrowing the scope allows for sharper positioning and more efficient testing. Early wins in a focused segment build momentum and provide insights that guide broader expansion later.

Pricing strategy is another critical decision. North American buyers often associate price with quality, but they also expect justification. A pricing model must align with perceived value and local competition, not simply currency conversion.

Positioning Your Brand for Trust and Relevance

Brand perception matters deeply in North America. Buyers want to understand who you are, what you stand for, and why they should choose you over familiar alternatives.

Clear messaging is essential. Your brand story should explain the problem you solve, how you solve it differently, and what results customers can expect. Avoid jargon and vague claims. Specific outcomes resonate far more than general promises.

Cultural alignment also plays a role. Tone, visuals, and communication style should feel familiar and approachable to local audiences. This does not mean abandoning your identity. It means translating it in a way that feels relevant.

The Role of Digital Presence in Market Entry

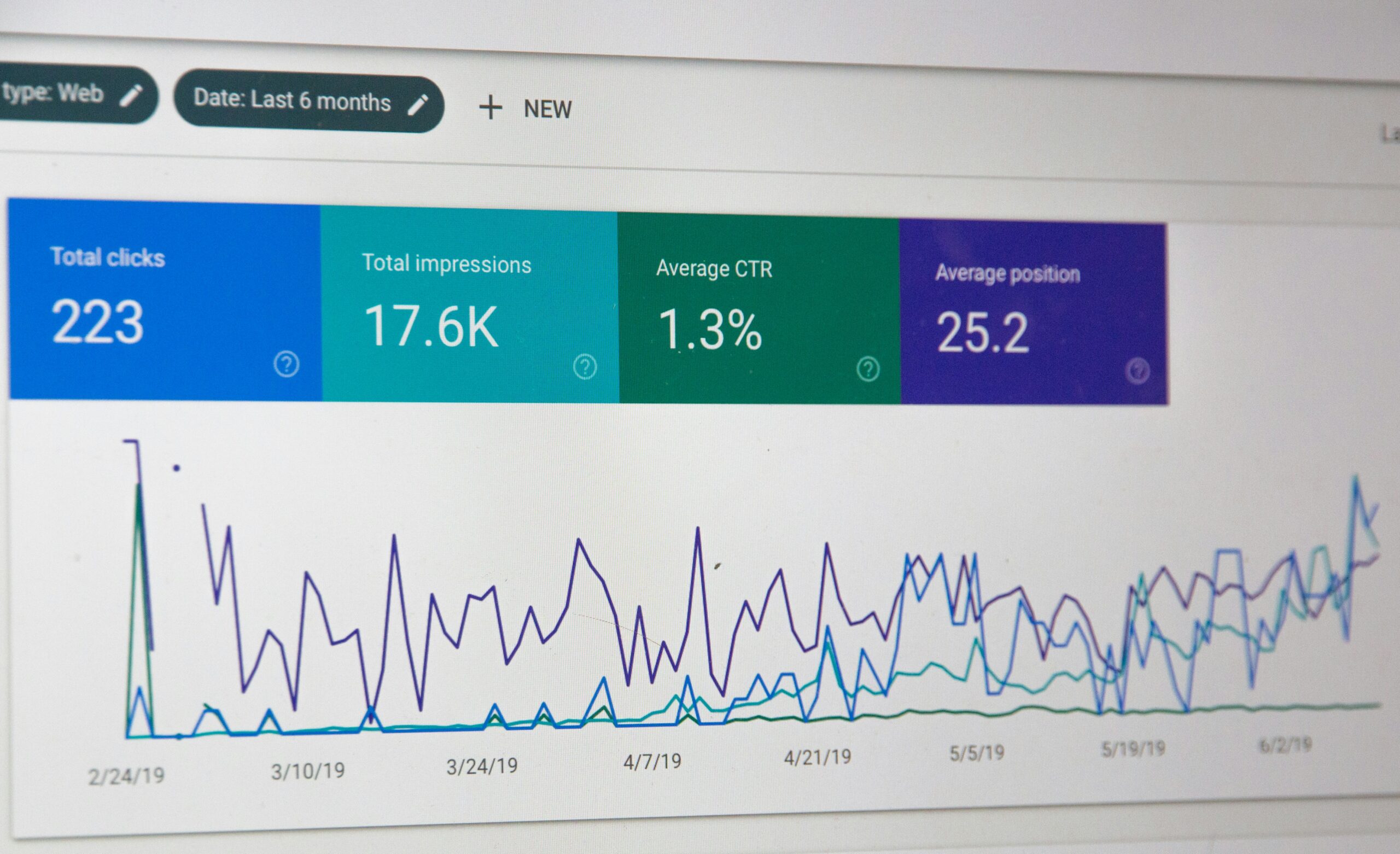

Your digital presence often forms the first impression for North American buyers. Before speaking to a sales representative or requesting a demo, most prospects will research your company online.

Your website should be clear, professional, and easy to navigate. It must answer key questions quickly and remove uncertainty. Buyers want to know where you operate, who you serve, and how they can engage with you.

Search visibility is also critical. If prospects cannot find you when researching solutions, your brand may never enter their consideration set. This is where many international brands struggle, especially when competing against established local players.

Adapting to Local Buying Behavior

North American buyers value efficiency and clarity. They expect straightforward information and responsive communication. Long decision cycles are common in some industries, but transparency shortens them.

Content that educates rather than sells aggressively tends to perform better. Buyers want to feel informed and empowered, not pressured. Demonstrating expertise through helpful insights builds confidence and positions your brand as a serious contender.

Sales processes should reflect this mindset. Clear next steps, predictable timelines, and honest conversations foster trust. Overpromising or being vague can quickly erode credibility.

Building Credibility From the Ground Up

Credibility does not happen overnight, especially for brands entering from overseas. It is built through consistency, proof, and presence.

Customer testimonials, case studies, and documented results play a powerful role. Even if early customers are limited, their experiences provide social validation. Prospects want evidence that others like them have succeeded with your solution.

Local partnerships can also accelerate trust. Working with regional distributors, consultants, or industry groups signals commitment to the market and reduces perceived risk.

Navigating Competitive Pressure

Competition in North America is intense. In most industries, buyers already have multiple options. New entrants must clearly articulate why they are different and why that difference matters.

Competing solely on price is rarely sustainable. Instead, focus on areas where you offer distinct value. This could be innovation, service quality, speed, customization, or specialized expertise.

Understanding competitor positioning helps refine your own. Study how others communicate, what gaps they leave, and where customer dissatisfaction exists. These insights inform both messaging and product development.

Operational Considerations That Influence Success

Operational readiness is often overlooked but plays a major role in early success. Logistics, customer support, and fulfillment must meet local expectations.

Time zones, response times, and service availability matter. Customers expect timely communication and reliable delivery. Any friction in these areas can undermine confidence, even if the product itself is strong.

Legal and financial infrastructure must also be in place. Contracts, payment methods, and tax considerations should be addressed before scaling efforts.

Scaling Beyond Initial Entry

Once traction is achieved, scaling becomes the next challenge. Expansion should be deliberate and data driven.

Analyze which channels, regions, and segments are performing best. Invest more heavily where results are strongest rather than spreading resources too thin.

Hiring local talent often becomes necessary at this stage. Local teams bring cultural insight and market knowledge that cannot be replicated remotely. They also signal long term commitment to customers and partners.

Common Mistakes to Avoid

Many brands underestimate the importance of localization. Simply translating materials without adapting messaging often leads to poor engagement.

Another mistake is rushing expansion without validating demand. Early feedback should guide decisions, not assumptions based on home market success.

Ignoring brand perception can also be costly. Even technically strong products struggle if the brand feels unfamiliar or disconnected from customer needs.

Finally, lack of patience undermines long term potential. Building trust and recognition takes time, especially in competitive markets.

Why a Thoughtful Approach Wins

Breaking into North America is not about shortcuts. It is about clarity, preparation, and execution.

Brands that invest in understanding the market, aligning their messaging, and building credibility create a strong foundation for growth. Those that approach entry strategically rather than opportunistically are far more likely to succeed.

Companies from Asia that take the time to adapt rather than replicate position themselves for sustainable results. By respecting local expectations while showcasing their unique strengths, they can compete effectively and build lasting presence.

Final Thoughts on Market Entry

Entering North America is both a challenge and an opportunity. The market rewards brands that are disciplined, transparent, and customer focused.

With the right blueprint, international brands can move beyond initial barriers and establish themselves as trusted players. Success comes from preparation, not luck.

When strategy, messaging, and execution align, the transition from global ambition to regional success becomes achievable.