Expanding into North America is a major milestone for established companies looking to grow beyond familiar territory. The region offers scale, purchasing power, and access to some of the world’s most competitive industries. It also presents challenges that can catch even experienced organizations off guard. Success depends less on ambition and more on preparation, clarity, and disciplined execution.

This guide is designed for leadership teams planning a thoughtful and sustainable expansion. It focuses on real world considerations that influence outcomes long after the initial market entry announcement.

Understanding the Complexity of the North American Market

North America is often treated as a single destination, but it is far more complex in practice. Buying behavior varies widely across industries, regions, and customer types. Expectations in New York may differ significantly from those in Texas or British Columbia.

Customers are accustomed to choice. They research extensively, compare alternatives, and expect transparency from the very first interaction. New entrants are evaluated quickly, and first impressions carry lasting weight.

Competition is another defining factor. In most sectors, established brands already dominate mindshare. Breaking through requires relevance, not just presence.

Setting a Clear Expansion Objective

A common mistake companies make is approaching expansion with vague goals. Entering a new market without clear objectives leads to unfocused messaging and inefficient use of resources.

A strong expansion plan starts by defining what success looks like. This could mean acquiring a specific type of customer, validating demand for a product, or establishing a regional foothold. Clear objectives help teams prioritize actions and measure progress accurately.

It is also important to determine whether the initial goal is learning or scaling. Early phases often benefit from controlled experimentation rather than aggressive growth targets.

Choosing the Right Market Entry Point

Trying to appeal to everyone at once rarely works. Successful companies identify a specific entry point that aligns with their strengths.

This may involve targeting a particular industry vertical, customer size, or geographic region. Focus allows for sharper positioning and faster feedback. It also reduces operational strain during the early stages.

Once traction is achieved in a defined segment, expansion becomes easier and more predictable.

Translating Value for a New Audience

A product that performs well in one market does not automatically resonate in another. Value must be communicated in a way that aligns with local expectations and priorities.

North American buyers favor clarity and specificity. They want to understand how a solution fits into their workflow and what outcomes they can expect. Broad claims without supporting detail tend to be ignored.

Messaging should emphasize practical benefits rather than abstract advantages. Clear language builds confidence and reduces friction in the buying process.

Building Brand Credibility From Day One

Brand credibility plays a central role in market expansion. Buyers are cautious when evaluating unfamiliar companies, especially those based overseas.

Consistency across branding, messaging, and presentation is essential. Visual identity, tone, and positioning should reinforce one another. Any disconnect can create doubt.

Professionalism matters. Buyers expect polished communication, clear documentation, and predictable engagement. These signals help establish legitimacy early.

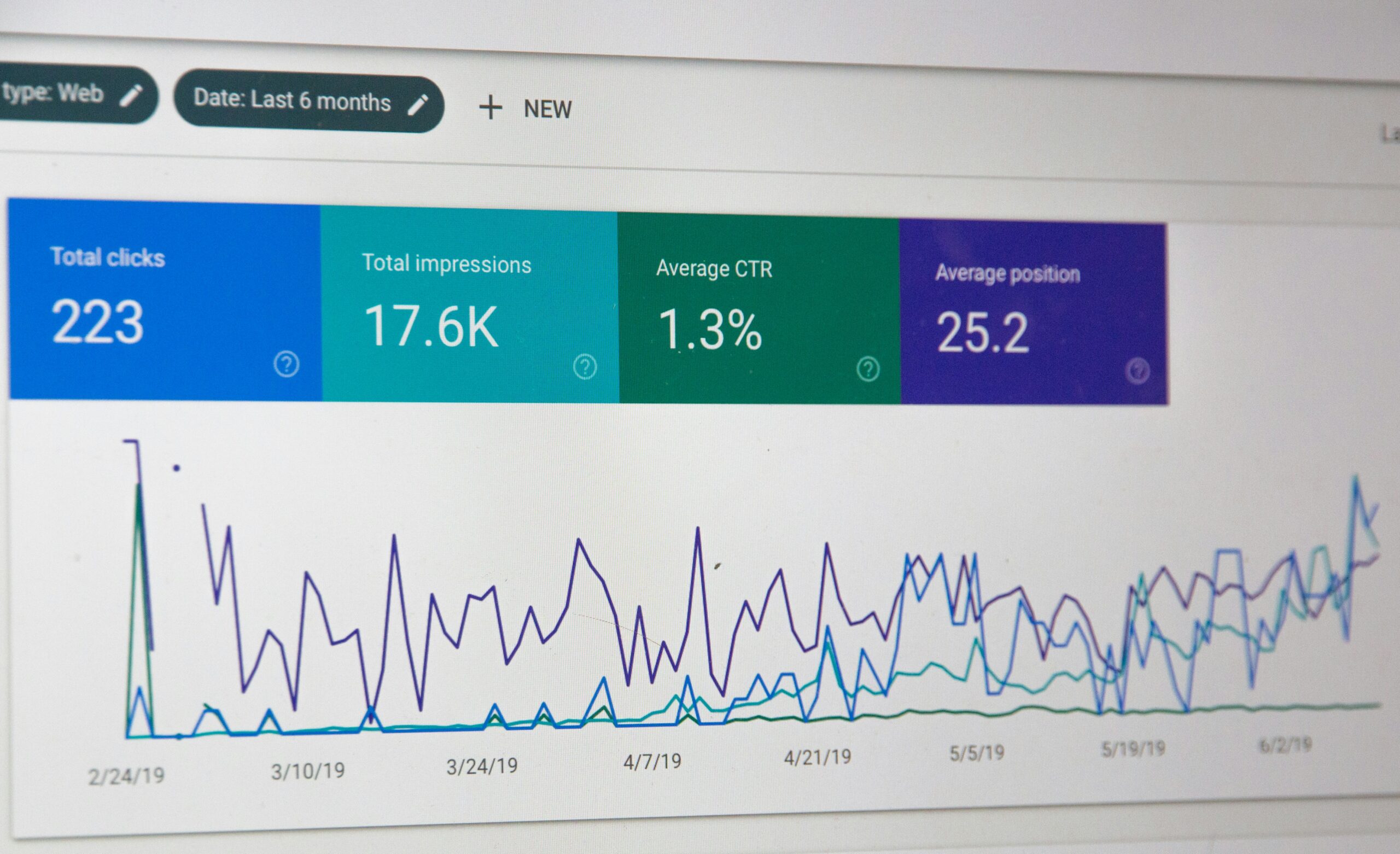

Creating a Strong Digital Presence

For most buyers, digital channels form the first impression. Before engaging directly, prospects research online to assess credibility and fit.

A well structured website is critical. Visitors should immediately understand what the company does, who it serves, and how to engage. Confusion at this stage often leads to lost opportunities.

Search visibility also influences discovery. If potential customers cannot find a company during early research, it may never enter their consideration set. Clear service descriptions and consistent information support visibility and trust.

Adapting to Local Buying Behavior

Buyers in North America value efficiency and transparency. They expect prompt responses, straightforward processes, and honest communication.

Educational content often outperforms aggressive sales messaging. Buyers want to feel informed before committing. Companies that provide useful insights position themselves as trusted partners rather than vendors.

Sales processes should reflect this mindset. Clear next steps, realistic timelines, and direct answers help move decisions forward.

Establishing Trust Without a Local Track Record

Trust is built through proof and consistency. For companies entering a new market, early validation is especially important.

Customer success stories, case studies, and measurable results help bridge the trust gap. Even a limited number of strong examples can influence perception significantly.

Local advisors or partners can also accelerate credibility. Their presence signals commitment to the market and reduces perceived risk for potential customers.

Operational Readiness and Execution

Interest alone does not lead to growth. Operational readiness determines whether early momentum translates into long term success.

Customer support expectations must be met. Response times, availability, and communication style all affect satisfaction. Time zone differences should be planned for rather than treated as an inconvenience.

Administrative processes matter as well. Contracts, billing, and compliance should be clear and reliable. Friction in these areas can undermine confidence quickly.

Competing in a Mature Market

Competition in North America is intense across most industries. Buyers usually have existing relationships and established preferences.

Winning does not always mean offering the lowest price. Many buyers prioritize reliability, expertise, and service quality. Differentiation should be intentional and clearly communicated.

Understanding competitors helps refine positioning. Identifying gaps in the market often reveals opportunities to stand out in meaningful ways.

Scaling With Discipline

Once initial traction is achieved, scaling becomes the next challenge. Growth should be guided by data rather than enthusiasm.

Focus on channels and segments that perform best. Expand thoughtfully instead of broadly. Each step should build on validated success.

Hiring locally often becomes important as operations grow. Local teams bring market insight and cultural understanding that strengthen relationships and accelerate expansion.

Common Pitfalls to Avoid

One frequent mistake is assuming that past success guarantees future results. Each market has its own norms and expectations.

Another issue is underestimating the time required to build trust. Visibility alone does not equal credibility. Consistency and follow through matter.

Overextending resources too early can also stall progress. Sustainable growth favors patience and focus.

Taking a Long Term View

Market expansion is not a single event. It is an ongoing process of learning, refinement, and adaptation.

Companies that approach growth with humility and curiosity are better positioned to adjust. Listening to feedback and responding thoughtfully builds resilience.

For organizations expanding from Europe, success in North America represents more than geographic growth. It reflects strategic maturity and global readiness.

Final Thoughts

Entering a competitive market requires more than confidence. It demands preparation, clear communication, and operational excellence.

North America rewards companies that respect its complexity and meet its expectations with professionalism. With the right strategy, international businesses can build credibility and achieve lasting growth.

When clarity, execution, and commitment align, expansion becomes a calculated step forward rather than a risky leap.