SEO Banking has become a reliable growth strategy for financial institutions that want better results from their digital marketing efforts. Instead of focusing only on website traffic, many banks and financial service providers now prioritize lead quality. After all, more visitors do not always mean more customers.

In today’s digital environment, financial decisions often begin with a search engine. Because of this shift, SEO Banking plays a key role in connecting institutions with people who are actively looking for financial solutions. When done correctly, SEO Banking attracts users who are prepared to take the next step.

As a result, financial organizations can reduce wasted marketing spend while improving conversion rates. Throughout this article, we will explain how SEO Banking improves lead quality, why that matters for financial services, and how a strong SEO foundation supports long term success.

Understanding Lead Quality in Financial Services

Lead quality refers to how likely a potential customer is to move forward and become a real client. In financial services, this is especially important because products often involve trust, long term commitment, and detailed decision making.

While some website visitors may only be browsing, others are actively searching for solutions. Therefore, financial institutions must focus on attracting users with clear intent. SEO Banking helps make that distinction by aligning content with what serious prospects are searching for.

High quality financial leads usually show several signs:

They search for specific banking services

They spend time reading helpful content

They understand their financial needs

They are ready to speak with an expert

Because SEO Banking targets these behaviors, it consistently produces stronger leads than broad marketing tactics.

How SEO Banking Attracts High Intent Searchers

Search intent is one of the most important factors in lead quality. Some searches are informational, while others show a clear desire to take action. For this reason, SEO Banking focuses heavily on intent driven keywords.

Instead of chasing general traffic, SEO Banking targets searches that signal readiness. These searches often include service focused terms, local banking queries, and problem based phrases. As a result, the users arriving on your website are more likely to convert.

Common high intent searches supported by SEO Banking include:

Banking services near me

Business or personal loan options

Local financial institutions

Account opening and consultation requests

By targeting these searches, SEO Banking filters out low value traffic and attracts users who are closer to making a decision.

Why Trust Matters in SEO Banking

Trust is essential in the financial industry. Without it, even the most qualified prospect may hesitate to move forward. Fortunately, SEO Banking helps build trust before a user ever contacts your institution.

First, strong search visibility signals credibility. When users see your institution ranking highly in search results, they often view it as more reliable. Additionally, SEO Banking supports trust through content quality and website performance.

Key trust building elements include:

Clear and helpful educational content

Easy to understand service pages

Fast and secure website performance

Simple and logical site navigation

Together, these elements create confidence and encourage users to take the next step.

Content Strategy as the Core of SEO Banking

Content plays a central role in SEO Banking. However, not all content produces quality leads. Financial institutions must focus on clarity, accuracy, and usefulness rather than volume.

A strong SEO Banking content strategy includes:

Educational articles that answer common questions

Service pages that explain offerings clearly

Location based content for local searches

Blog posts that guide users through decisions

As a result, visitors arrive better informed and more confident. Consequently, the leads generated through SEO Banking are more prepared and more valuable.

Educational Content and Lead Readiness

Educational content allows users to self qualify before reaching out. By explaining processes, requirements, and benefits, SEO Banking content prepares prospects early.

Because of this preparation, conversations begin at a more advanced stage. Therefore, financial teams spend less time explaining basics and more time helping serious prospects.

Technical SEO Banking and User Experience

Even the best content will struggle if a website performs poorly. That is why technical SEO Banking is so important for lead quality. A slow or confusing site can quickly drive users away.

SEO Banking focuses on improving user experience through:

Fast loading pages

Mobile friendly design

Clear navigation paths

Secure browsing environments

As a result, users can easily find what they need. When friction is reduced, conversions naturally increase.

Local SEO Banking and Qualified Leads

For banks with physical locations, local SEO Banking is especially valuable. Local searches often show strong intent because users are looking for nearby services.

SEO Banking helps institutions appear in searches such as:

Banks near me

Local mortgage lenders

Nearby business banking services

Financial advisors in a specific area

Because these searches are location based, the leads they generate are more likely to result in visits, calls, or appointments.

SEO Banking Compared to Broad Digital Advertising

Many financial institutions rely on paid ads for lead generation. While advertising can deliver quick visibility, it often attracts users who are not ready to commit.

SEO Banking works differently. Organic search traffic is driven by intent rather than interruption. As a result, users who find your site through SEO Banking are often more engaged.

Compared to broad advertising, SEO Banking offers:

Higher quality leads over time

Lower long term cost per lead

Stronger trust and credibility

More sustainable growth

For this reason, SEO Banking provides long lasting value beyond short term campaigns.

Compliance and Accuracy in SEO Banking

Financial services operate under strict regulations. Therefore, SEO Banking must always balance optimization with accuracy and compliance.

A responsible SEO Banking strategy ensures:

Accurate financial information

Clear disclosures where required

Consistent messaging across pages

Ethical and transparent practices

By maintaining compliance, institutions attract informed prospects while protecting their reputation.

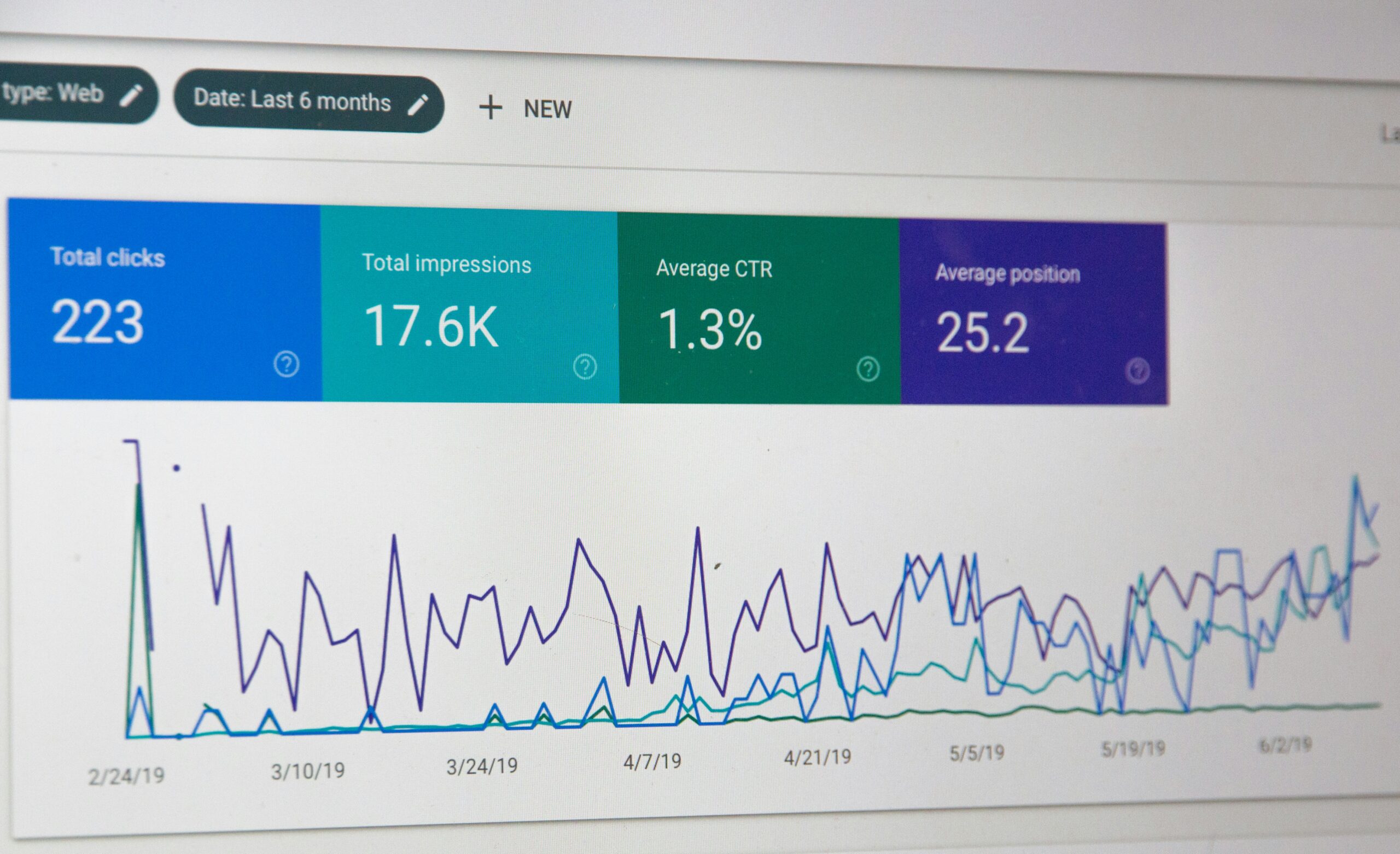

Measuring Lead Quality From SEO Banking

Measuring results is essential for improvement. SEO Banking provides clear data that helps institutions understand lead quality.

Important metrics include:

Organic conversion rates

Time spent on key pages

Form completion behavior

Lead to customer conversion rates

By reviewing this data, financial institutions can refine their SEO Banking strategies and continue improving results.

Long Term Benefits of SEO Banking

SEO Banking is not a quick fix. Instead, it is a long term investment that grows stronger over time. As authority increases, lead quality improves consistently.

Long term benefits include:

Steady organic traffic growth

Improved brand trust

Higher customer lifetime value

Reduced reliance on paid advertising

Because of this, SEO Banking supports sustainable growth for financial institutions.

Choosing the Right SEO Banking Partner

SEO Banking requires industry specific expertise. Financial services SEO involves trust, competition, and compliance considerations that demand experience.

At Skyfield Digital, SEO Banking strategies are designed to attract qualified leads rather than empty traffic. Our focus remains on long term growth, improved conversions, and meaningful results.

Final Thoughts on SEO Banking and Lead Quality

SEO Banking is one of the most effective ways to improve lead quality for financial services. By focusing on intent, trust, and usability, SEO Banking attracts prospects who are ready to engage.

Rather than chasing traffic numbers, SEO Banking prioritizes relevance. As a result, financial institutions see better conversations, higher conversions, and stronger relationships.

For organizations seeking steady and scalable growth, SEO Banking is a core digital strategy that delivers lasting value.